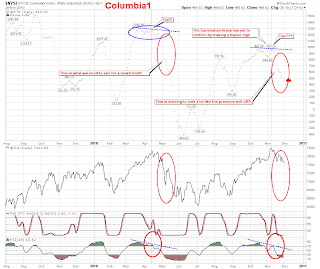

This is the Summation Index from yesterday's close, confirming that the trend is down, as it accelerates lower.

This is the Summation Index from yesterday's close, confirming that the trend is down, as it accelerates lower. Click here for a live, and updated chart!!!

Click here for a live, and updated chart!!!7:16, The short-term counts are really getting messy and VERY unreliable. The trend does remain down until the SPX can start printing higher highs and 1156 is still looking like a spot for a possible bounce if the SPX continues along its present path.

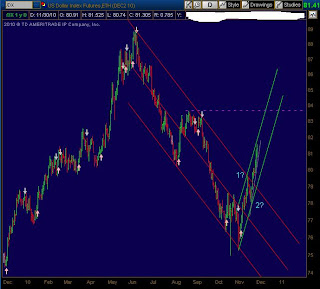

The Dollar made another new high today, and now has $81.525 as the HOD. The short-term trendline is still holding bullish, but the Dollar can also be counted as an a-b-c up, instead of the 1?-2? on the labels. At $82.41, wave "C" would be equal to the "A" wave, something to keep an eye on, that is why the short-term trendline is important.

The Dollar made another new high today, and now has $81.525 as the HOD. The short-term trendline is still holding bullish, but the Dollar can also be counted as an a-b-c up, instead of the 1?-2? on the labels. At $82.41, wave "C" would be equal to the "A" wave, something to keep an eye on, that is why the short-term trendline is important.On related news, Gold is up $16.00 to $1384.00 this morning, if these levels hold, a buy signal will be triggered from the daily Trendfinder at the close of the day.

good stuff. have been surprised that the folks who are very bullish (pug, caldaro) don't seem to pay any attention to the mcclellan indices. i track teh T2118 and it ihas already crossed the 20 and 50 dma and is right at the 200. i also question whether a rally up can follow through until the bullish sentiment corrects down at least to lower mid range, if not outright bearish.

ReplyDelete