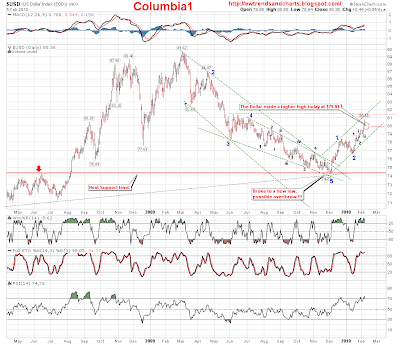

This is just to show that I am not a perma-bear, I really am bullish on a couple things, the Dollar, and the VIX, hehe. One encouraging sign I see on this chart is that the RSI has not peaked, or has shown negative divergence yet, and that normally indicates that the iii of the 3rd wave has not yet been put in.

This is just to show that I am not a perma-bear, I really am bullish on a couple things, the Dollar, and the VIX, hehe. One encouraging sign I see on this chart is that the RSI has not peaked, or has shown negative divergence yet, and that normally indicates that the iii of the 3rd wave has not yet been put in. This is a chart of the McClellan Oscillator for the last two and a half years. I wanted to go back and compare the extreme readings of the peaks and valleys with the $NYA Index itself and see if there was any correlation between the two. I set the neon green vertical lines at important tops and bottoms of the index to see how they lined up with the Oscillator. It quickly became evident, that just because the McClellan Oscillator bottomed, it did not mean the index had bottomed, or topped at the exact same time. In a few incidences, the M.O. bottomed, then diverged, and it was not until the Oscillator crossed the "Zero" line, that a change in trend can be seen.

This is a chart of the McClellan Oscillator for the last two and a half years. I wanted to go back and compare the extreme readings of the peaks and valleys with the $NYA Index itself and see if there was any correlation between the two. I set the neon green vertical lines at important tops and bottoms of the index to see how they lined up with the Oscillator. It quickly became evident, that just because the McClellan Oscillator bottomed, it did not mean the index had bottomed, or topped at the exact same time. In a few incidences, the M.O. bottomed, then diverged, and it was not until the Oscillator crossed the "Zero" line, that a change in trend can be seen.Now we have the M.O. below the "zero" line, which is still short-term bearish for the index, and should stay that way until it crosses back above the line.

This is a daily Breadth chart, and here you can see the strength between the advancing and declining issues, notice that the ratio has been favoring the bears for the last three weeks, and when the indexes rally, it is quick, and not with the amount of conviction of the sell-offs.

This is a daily Breadth chart, and here you can see the strength between the advancing and declining issues, notice that the ratio has been favoring the bears for the last three weeks, and when the indexes rally, it is quick, and not with the amount of conviction of the sell-offs. This chart of the percent of stocks above their 50 day moving average now has the opposite look then it did when we bottomed last February, complete with the divergence before hand, and lots of room to run to the downside. My guess is that when the 3rd wave of the 1st down bottoms, the percent of stocks below their 50 day will also bottom, then diverge for the 5th of the 1st wave down. This is not a very friendly chart for the Bulls, and is another sign that all of the sectors are taking part in this sell-off.

This chart of the percent of stocks above their 50 day moving average now has the opposite look then it did when we bottomed last February, complete with the divergence before hand, and lots of room to run to the downside. My guess is that when the 3rd wave of the 1st down bottoms, the percent of stocks below their 50 day will also bottom, then diverge for the 5th of the 1st wave down. This is not a very friendly chart for the Bulls, and is another sign that all of the sectors are taking part in this sell-off.

No comments:

Post a Comment