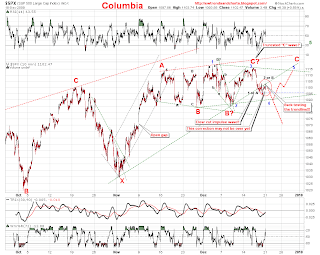

8:26, This might look confusing, but I tried to label the two most likely options as I see them. The Ending Diagonal Triangle that I have been showing for the last couple of weeks is still valid, but still needs one more wave down to finish of the 4th wave. That impulse wave down on Thursday made the shape of the triangle a little awkward, but still should stay valid unless 1085.89 gets taken out.

8:26, This might look confusing, but I tried to label the two most likely options as I see them. The Ending Diagonal Triangle that I have been showing for the last couple of weeks is still valid, but still needs one more wave down to finish of the 4th wave. That impulse wave down on Thursday made the shape of the triangle a little awkward, but still should stay valid unless 1085.89 gets taken out.The other option would be, that the "C" wave truncated. If so, we could see a large sell-off early next week. This option I am a little sceptical about, there just has not been high enough breadth nor sell volume in the 1st wave down to support this.

With either option , it is quite possible that the "B" wave, or the 2nd wave have yet to fully play-out, with a little more upside possible first thing Monday morning. This is where the EW and the TA are diverging, most of the TA is saying that there is more upside, but the EW is saying we need to sell-off a little further (finish the 4th wave), before trying to make a new high, or the top is in and a larger sell-off is in the works.

To complicate the matter, the Bollinger bands on the daily charts, are still as tight as I have seen them for the last few years, and that is making me worrisome that something big is very close at hand. And just to make it worse, it is not uncommon to have the first break-out of the bands a head-fake, before it reverses in the true direction.

I will be adding charts through out the day, and will put together a final post in the morning tying everything together.

nice updates (alternatives) - thanks!

ReplyDeletemy own thought is that with two shortened holiday weeks coming up, and the history of the HFT people and others who seem to be able to move the markets at will during low trade low volume days, that we will see what the majority of the big money interests want: more upside

after that, well, we'll see ;-)

I am admittedly weak in EW theory. Fascinating to be sure, and in hindsight for me much clearer.

ReplyDeleteFor now it's range trading when you ignore the marginal tails. Look at the box on oex from 11/09 and it shows high level base building or churning to me. Models that go too far out seem to be like predicting the weather 3 months from now rather than for the next few days.

As a trader, I like to find regression to the mean and then look for new clues. HFT upside idea presented by adan presumes we can also look for signs of distribution during an advance into the next fib levels.

Your work is fascinating, as well as profitable.

Thank you.

E