This chart here, shows the number of stocks above their 50 day Moving Average, I use it to help confirm tops and bottoms as well as determine the longer-term trend. This is now very close to confirming a new trend that is bullish. The price action has already turned up, and once the 20 day MA (that orange line) crosses the price, that will confirm the new bullish trend. Any close tomorrow that is positive on the SPX will surely confirm a new trend, the bears REALLY need a strong sell-off to avoid the 20 day MA crossing the price action.

This chart here, shows the number of stocks above their 50 day Moving Average, I use it to help confirm tops and bottoms as well as determine the longer-term trend. This is now very close to confirming a new trend that is bullish. The price action has already turned up, and once the 20 day MA (that orange line) crosses the price, that will confirm the new bullish trend. Any close tomorrow that is positive on the SPX will surely confirm a new trend, the bears REALLY need a strong sell-off to avoid the 20 day MA crossing the price action.  2nd chart, is also warning the current down trend is in jeopardy, printing its first black bar in six weeks. The Summation Index is a longer term index that does have lag to it, but is also great for determine the trend. It can sit around this level and consolidate, but any break to the upside, that starts to accelerate by printing bars that are further, and further, apart will confirm the trend has changed to bullish. Right now, I read this chart as now neutral.

2nd chart, is also warning the current down trend is in jeopardy, printing its first black bar in six weeks. The Summation Index is a longer term index that does have lag to it, but is also great for determine the trend. It can sit around this level and consolidate, but any break to the upside, that starts to accelerate by printing bars that are further, and further, apart will confirm the trend has changed to bullish. Right now, I read this chart as now neutral. And the McClellan Oscillator moved into the green today, also a lagging indicator, but now bullish, the bears do have a slight bit of good news in this chart, the STO is close to rolling over and giving a sell signal, but using this is not always a given the market will follow suit and go bearish.

And the McClellan Oscillator moved into the green today, also a lagging indicator, but now bullish, the bears do have a slight bit of good news in this chart, the STO is close to rolling over and giving a sell signal, but using this is not always a given the market will follow suit and go bearish. Here is the SPX with just the bullish count on it, although the start of this rally is no where near a picture perfect impulse wave, it can still be counted as one, something that the bears need to keep an eye on if we continue heading higher. The Market is at a crossroad right now, and much more upside will swing the majority of the TA over to the bulls. Even "The Maestro" Kenny has been warning for days that the bears need to take this rally more serious and see both sides!!!

Here is the SPX with just the bullish count on it, although the start of this rally is no where near a picture perfect impulse wave, it can still be counted as one, something that the bears need to keep an eye on if we continue heading higher. The Market is at a crossroad right now, and much more upside will swing the majority of the TA over to the bulls. Even "The Maestro" Kenny has been warning for days that the bears need to take this rally more serious and see both sides!!! Here is an interesting observation, after playing around with some parallel trendlines (gray), with equal distances between them, I found that they might be providing a clue about how this next move could work-out, we shall see if the next one does provides resistance.

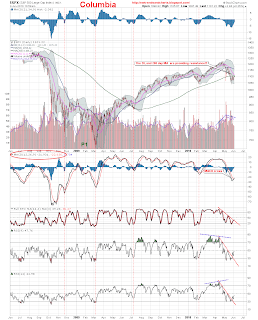

Here is an interesting observation, after playing around with some parallel trendlines (gray), with equal distances between them, I found that they might be providing a clue about how this next move could work-out, we shall see if the next one does provides resistance. After the close, The SPX has now cornered itself into an quadrum, in order to fill the gap, it now also has to break above the major trendline of resistance running from the high back at 1219.80, along with taking out the 200 day MA which closed at 1106.24, and possibly the 20 day MA at 1111.57. Those three obstacles are providing very stiff resistance, and in the event the SPX does break above and fill that gap, the TA is going to heavily start favoring the Bulls case for new highs.

After the close, The SPX has now cornered itself into an quadrum, in order to fill the gap, it now also has to break above the major trendline of resistance running from the high back at 1219.80, along with taking out the 200 day MA which closed at 1106.24, and possibly the 20 day MA at 1111.57. Those three obstacles are providing very stiff resistance, and in the event the SPX does break above and fill that gap, the TA is going to heavily start favoring the Bulls case for new highs. The trend is still neutral, but at the high of 1119.83, the trend will go bullish. The SPX did really struggle hard today to make a higher high, above the initial high made near the open, in a long drawn out series of over-lapping waves slowing crawling back uphill.

We could have a very interesting open tomorrow, after all the pumping up of the unemployment data with expectation of new jobs created nearing the 600k mark, the Market might be getting set-up for a large disappointment and we could end up with a truncated 5th of "C", of 2up wave.

If you thought the market had that boring feel all day, and you are not alone, you should be happy to know the Breadth confirmed that feeling, closing at 1.78:1, advancers.

We could have a very interesting open tomorrow, after all the pumping up of the unemployment data with expectation of new jobs created nearing the 600k mark, the Market might be getting set-up for a large disappointment and we could end up with a truncated 5th of "C", of 2up wave.

If you thought the market had that boring feel all day, and you are not alone, you should be happy to know the Breadth confirmed that feeling, closing at 1.78:1, advancers.

8:01, The Good news, Bad news chart, the daily chart is going bullish, but with some obstacles in the way. The RSI has broke the downtrend, and is now on a buy, and the MACD has crossed with its histo-gram going positive, but with-out any divergences. On the flip-side, volume is drying up, the 20 and 200 day MA are going to provide resistance at 1111.49, and 1106.23, respectively, and the 21, 34 histogram is still negative, but trending upwards.

8:01, The Good news, Bad news chart, the daily chart is going bullish, but with some obstacles in the way. The RSI has broke the downtrend, and is now on a buy, and the MACD has crossed with its histo-gram going positive, but with-out any divergences. On the flip-side, volume is drying up, the 20 and 200 day MA are going to provide resistance at 1111.49, and 1106.23, respectively, and the 21, 34 histogram is still negative, but trending upwards. Click here for a live, and updated chart!!!

Click here for a live, and updated chart!!!7:51, On the longer term Fib fan chart, the SPX is pounding its head on one of the bearish fans, which should provide some resistance. Next point of resistance would be the trendline down from the top.(red line)

Click here for a live, and updated chart!!!

Click here for a live, and updated chart!!!7:47, The SPX is still in the most bullish part of the short-term fan, if this is indeed the "C" wave of the 2nd wave up, once this fan is broke to the downside, it should confirm that the 2nd wave up is over.

Click here for a live, and updated chart!!!

Click here for a live, and updated chart!!!7:16, We finally have an impulse wave going, and that really cleared up the squiggle counts by eliminating a lot of possibilities. With the peak on the RSI in the above chart, the highest probability would be it marks the iii of 3 wave, of hopefully wave "C" up.

I don't think we will see 1175 to go bullish for a long time...Nice Charts!

ReplyDeleteHey, mbew, long time no see!!!

ReplyDeletefor me, I believe we are at a crossroad right now, some TA will go long-term bullish if we start getting up around the 1150 level, otherwise, if we break 1060, look out!!!