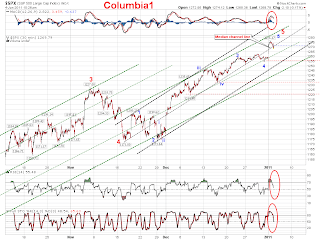

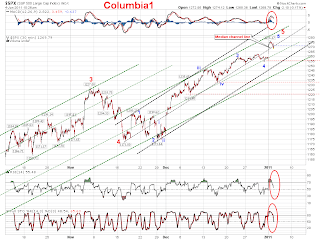

It is not the prettiest impulse wave, but it does look like a valid possibility.

It is not the prettiest impulse wave, but it does look like a valid possibility. Things are a lot different on the Russell, this is a nice looking impulsive wave, BTW, Copper mirrors this count.

Things are a lot different on the Russell, this is a nice looking impulsive wave, BTW, Copper mirrors this count. 10:28, The SPX finally made it down to the next level of support after breaking below the black median channel line this morning, now it is being held up by the green minor median channel line, if this breaks, then the SPX has its first opportunity to start making major lower lows and opening the door for a much larger sell-off.

10:28, The SPX finally made it down to the next level of support after breaking below the black median channel line this morning, now it is being held up by the green minor median channel line, if this breaks, then the SPX has its first opportunity to start making major lower lows and opening the door for a much larger sell-off. 10:21, Here is an early look at the daily candle so far on the Russell, I have never really spent much time studying the art of reading candles, but I do not think it takes much to understand this is not a bull friendly candle, at this point it is a bearish engulfing candle.

10:21, Here is an early look at the daily candle so far on the Russell, I have never really spent much time studying the art of reading candles, but I do not think it takes much to understand this is not a bull friendly candle, at this point it is a bearish engulfing candle. 9:47, Gold is still getting hammered since the open, now down $43 and over 3%. Gold is now testing the lower trendline, which if it fails, opens the door up for a much larger move to the downside!!!!

9:47, Gold is still getting hammered since the open, now down $43 and over 3%. Gold is now testing the lower trendline, which if it fails, opens the door up for a much larger move to the downside!!!!Silver update, much worse then Gold, down over 5%, and $1.58, this is now a mini crash in Silver!!!

The bottom has totally fell out on the 15 minute Russell chart, now down over 2% and down 17 points, and making important lower lows. Mid and large caps have not sold off near as hard as the small caps, a sign that investors are bailing out of risky stocks. If the Russell closes near these lows, it will produce one UGLY bearish engulfing candle on the daily charts.

The bottom has totally fell out on the 15 minute Russell chart, now down over 2% and down 17 points, and making important lower lows. Mid and large caps have not sold off near as hard as the small caps, a sign that investors are bailing out of risky stocks. If the Russell closes near these lows, it will produce one UGLY bearish engulfing candle on the daily charts. 8:20, The SPX is not impulsing down as much as Copper or the Russell, but is making minor lower lows on the day. The black median channel line did fail, and now support has moved down to the green line in the 1262 area. The biggie would be a break below 1254.19, that would be making an important lower low putting the up trend in serious jeopardy.

8:20, The SPX is not impulsing down as much as Copper or the Russell, but is making minor lower lows on the day. The black median channel line did fail, and now support has moved down to the green line in the 1262 area. The biggie would be a break below 1254.19, that would be making an important lower low putting the up trend in serious jeopardy. 8:16, The 15 minute chart now has the Russell breaking down into a wave that looks a lot better for an impulsive sell-off.

8:16, The 15 minute chart now has the Russell breaking down into a wave that looks a lot better for an impulsive sell-off. 7:59, Copper and the major indexes normally run together, with Copper leading at times. This is a 15 minute chart of Copper, and it looks to be impulsing down this morning, if Copper is leading I would expect the major indexes to follow suit. This could be an early warning sign. Copper is VERY close to signaling a sell on the daily Trendfinder.

7:59, Copper and the major indexes normally run together, with Copper leading at times. This is a 15 minute chart of Copper, and it looks to be impulsing down this morning, if Copper is leading I would expect the major indexes to follow suit. This could be an early warning sign. Copper is VERY close to signaling a sell on the daily Trendfinder. 7:44, The Bollinger bands are still tight on the VIX and the 20 day MA is still acting as support, so far this set-up is not looking bear friendly, the STO is reaching over-bought conditions and the VIX is constrained with-in a tight trading range, the bears need a big break-out to the up-side that follows-thru. So far, odds are favoring the equity bulls.

7:44, The Bollinger bands are still tight on the VIX and the 20 day MA is still acting as support, so far this set-up is not looking bear friendly, the STO is reaching over-bought conditions and the VIX is constrained with-in a tight trading range, the bears need a big break-out to the up-side that follows-thru. So far, odds are favoring the equity bulls. 7:26, The big fight right now looks to be on the median channel line in black, the indicators are suggesting that this support will soon give as all three are on a sell.

7:26, The big fight right now looks to be on the median channel line in black, the indicators are suggesting that this support will soon give as all three are on a sell. Click here for a live, and updated chart!!!

Click here for a live, and updated chart!!!7:15, The price action this morning broke the mold a little, with a gap up open, that quickly reversed and moved into negative territory. The bears need this to start impulsing down and making lower lows, the bulls need a corrective sell-off, filled with over-lapping waves. 1259.34 is a key level for the SPX, this is the top of 1st wave of the last set of squiggles, and if the SPX is still in a 4th wave this level cannot be broke, however, if the squiggles for the 5th are completed, this level should be broke quickly. As of now, I am leaning about 60% that this sell-off is corrective.

The big movers this morning are Gold and Silver, both down hard, with Silver taking the biggest hit, down currently 3.34%. Both did signal a sell at the open on the Trendfinder.

You sure the hell ain't fishing today. Thanks!

ReplyDelete