Click here for a live, and updated chart!!!

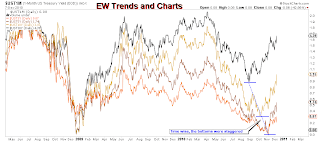

Click here for a live, and updated chart!!!7:38, The moment of truth is coming here soon, is this the blue 2nd wave down, or the start of a much larger correction. The SPX has now dropped down to its first point of support, the green median line. If this fails next in line would be the gray median line, this is also close to where the 38% retracement lays. The SPX would have to break all the way down to the 1175 level to start making serious lower lows, which would confirm a trend change.

TNX which tracks the yield on the 10 year treasury note is up 2.37% this morning, this bullish move broke above the previous high of $31.24, leaving $34.25 as the next level of resistance from a previous high.

TNX which tracks the yield on the 10 year treasury note is up 2.37% this morning, this bullish move broke above the previous high of $31.24, leaving $34.25 as the next level of resistance from a previous high.***Also of note, the Trendfinder has Silver and Gold moving to a sell, and the Dollar to a buy.

hey man ... actually dont agree.... i think bottom is in line with the 30years one and we had A..B(under bottom)... than C.... X and now this abc should be another A.... we need B down and C up dont need reach the max price.... just my thoughts... i think we are in a correction and mythoughts is.... yields will go much lower.... even under 2....... wil go to 1 something...

ReplyDeleteWow Creepy, that would be wild to have rates that low.

ReplyDeletethat is typical defltion 40 yr cycle scnario . 30 yr yeild to be around 2 by 2014-15 etc .. buy right now its getting amazing jump

ReplyDeleteyash... maybe we are crazy.... but i see same shit....

ReplyDelete