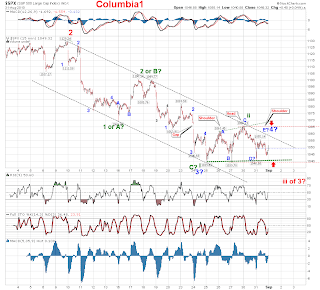

The last week has the SPX consolidating beneath the bullish Fib fan of resistance, not a great sign for the bulls not being able to regain that resistance and turn it back to support, for now support is down in the 1000 area, which also would be the last support from the long-term bullish fans

The last week has the SPX consolidating beneath the bullish Fib fan of resistance, not a great sign for the bulls not being able to regain that resistance and turn it back to support, for now support is down in the 1000 area, which also would be the last support from the long-term bullish fans After the close, The SPX is printing out one of the nicest head and shoulders patterns I have witnessed for a long time, I normally do not pay much attention to the pattern because it has been very disappointing in the past (869 still brings back bad memories). Downside target for this pattern would put it in the 1015 level, which is not too far from what a 5th wave might travel. The rest of the day was boring, with light volume and go-no-where Breadth readings, 1.24:1, advancers.

After the close, The SPX is printing out one of the nicest head and shoulders patterns I have witnessed for a long time, I normally do not pay much attention to the pattern because it has been very disappointing in the past (869 still brings back bad memories). Downside target for this pattern would put it in the 1015 level, which is not too far from what a 5th wave might travel. The rest of the day was boring, with light volume and go-no-where Breadth readings, 1.24:1, advancers.If this is part of the 4th wave the SPX still has a little more upside to finish-off the "E" wave, a test of the trendline near 1060 would be expected before the market gets back to selling-off in the 5th wave. For the 2nd wave option, the SPX needs to get moving downwards producing higher volume and breadth numbers then we have seen for the last month. These numbers will be the best "tell" as to which short-term count is correct because a 3rd wave down would produce the highest reading of the sell-off, where as a 5th wave would have lower readings and divergences would start showing up in the daily charts on the RSI.

The Trend still remains down as the SPX seems unable to print any minor higher highs, only lower lows, and until this changes the bears keep control.

Head and shoulders pattern does not look valid without the volume on the right side of the shoulder. Although the bigger head and shoulder pattern looks right :)

ReplyDeleteIt sure looks like wave 4.....the whole thing since the April top is hard to count I think.

ReplyDelete