The desent in the Summation Index is showing no slowing, keeping the larger-term trend bearish

The desent in the Summation Index is showing no slowing, keeping the larger-term trend bearish Yields on the longer-term bonds continue to fall faster then the shorter-term ones. The 10 year is getting down right ugly with no end in sight!!!

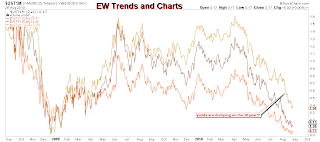

Yields on the longer-term bonds continue to fall faster then the shorter-term ones. The 10 year is getting down right ugly with no end in sight!!! Copper normally moves in tandem with the SPX, but lately there has been a disconnect, either the SPX is going to rocket upwards, or Copper is heading for a major sell-off. The is the chart I mention yesterday as one of a very few charts that could be bullish for the SPX.

Copper normally moves in tandem with the SPX, but lately there has been a disconnect, either the SPX is going to rocket upwards, or Copper is heading for a major sell-off. The is the chart I mention yesterday as one of a very few charts that could be bullish for the SPX. The SPX continues to try and break above resistance from the long-term Bullish Fib fan, but has not had enough gusto to do so, soon it will hit the resistance from the bearish Fib fan at 1060ish, there is very little support right now to keep the SPX from making a new low!!!

The SPX continues to try and break above resistance from the long-term Bullish Fib fan, but has not had enough gusto to do so, soon it will hit the resistance from the bearish Fib fan at 1060ish, there is very little support right now to keep the SPX from making a new low!!! After the close, The SPX definitely had no follow-thru to yesterday's bullish session, peaking early in the day, then selling-off for the majority of the day closing .74% down. The bulls have been incapable of making any serious higher highs as the SPX continues to stair-step its way back down to 1010.91 leaving three open gaps on this sell-off that started from the beginning of August. 1039.83 is the next support level, that if it gives, opens the door for the SPX to test 1010.91 as there is not much in the way for support on the way down to test the lows.

After the close, The SPX definitely had no follow-thru to yesterday's bullish session, peaking early in the day, then selling-off for the majority of the day closing .74% down. The bulls have been incapable of making any serious higher highs as the SPX continues to stair-step its way back down to 1010.91 leaving three open gaps on this sell-off that started from the beginning of August. 1039.83 is the next support level, that if it gives, opens the door for the SPX to test 1010.91 as there is not much in the way for support on the way down to test the lows.If the SPX can break above Tuesday gap, there is a wide range of resistance from many different sources to break thru before it can even test 1131.23 and make a major higher high, moving the longer-term trend to bullish. As of now the short-term trend is neutral after the SPX made a minor higher high when it broke above 1060.07 yesterday. If the SPX can break above today's high, the short-term trend would move the bullish, and if 1039.83 gives, it will be back the bearish.

Breadth for the day ended at 1.81:1, decliners, slightly higher then yesterday's bullish readings, but nothing to write home about.

I still have the rally that started yesterday labeled as a 2nd wave up because the form of the wave fits better as a 2nd, compared to a 4th. I still have the 4th wave option on my radar as having good odds, the 2nd wave option has slightly higher odds in my opinion.

The Trend Finder's short-term signals have been bouncing around today, something that is very unusual as three of them have been showing weak signals for the last couple of days, the longer-term indicators are still all on a sell.

One piece of bad psychological news for the bulls today is the DOW closed beneath 10,000!!!

***Today's intra-day charts and the comments that go along with them are posted below

thanks for the analysis. bulls had a perfect opportunity to push the market higher today, but due to the lack of buyers, the market drifted lower and lower for the most part of the day.

ReplyDeleteBlack, 100% agree, there are just NO buyers!!!

ReplyDeleteGood point about the NASI...

ReplyDelete