This short-term Fib fan has been on fire for the last couple of weeks. When they are working this good, they are very impressive to watch through the trading day, as they are giving time dependent support and resistance levels.

This short-term Fib fan has been on fire for the last couple of weeks. When they are working this good, they are very impressive to watch through the trading day, as they are giving time dependent support and resistance levels. The Fib fans could be giving us some clues as to where the future bounces could take place. Fib fan resistance is around 1130, and support at 1060, they both vary according to time.

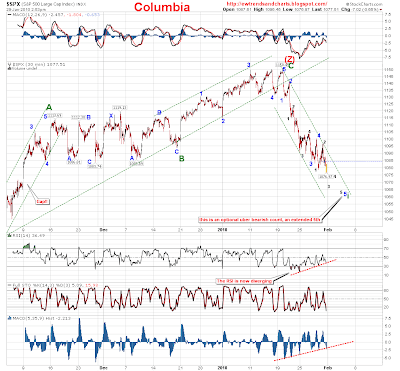

The Fib fans could be giving us some clues as to where the future bounces could take place. Fib fan resistance is around 1130, and support at 1060, they both vary according to time. After the close, the chart above is the other option I was referring to at 11:55, as of now, the above chart, and below chart are the two options I have going, and both are calling for lower lows, one just a little lower then the other.

After the close, the chart above is the other option I was referring to at 11:55, as of now, the above chart, and below chart are the two options I have going, and both are calling for lower lows, one just a little lower then the other.We did made a lower low again today so that trend is still down, but we are still seeing major divergences across the board signaling that this sell-off is getting tired, Breadth and volume are also confirming that. Breadth ended the day at only 2.16:1, decliners, and volume is down off of its peaks from earlier this week.

FWIW, I stayed in cash in my Wall Street Survivor account for the week-end, as close as we are to the finishing of the final 5th, the risk is not worth holding short over the week-end, it is possible that the ES-Minis trading after-hours could put in the 5th, and the cash market open Monday morning gap up in wave 2 up.

11:55, Well that option I posted at 11:22 did not last long, as we just made a lower low eliminating a couple of the options I had going, leaving me with the extended 5th pictured above, or this sell-off being the final 5th, that would require me to move the blue 3 over to the right, and down to where I have the small black 1.

11:55, Well that option I posted at 11:22 did not last long, as we just made a lower low eliminating a couple of the options I had going, leaving me with the extended 5th pictured above, or this sell-off being the final 5th, that would require me to move the blue 3 over to the right, and down to where I have the small black 1. 11:22, Throwing out an observation here, still too earlier to put much confidence in this, but with the structure of the two waves since yesterday's low at 1078.46, that are very corrective looking, it is possible that we are already in wave 2 up, with only a quick rally left to 1105.94, to hit the 38% retracement level from the high of 1050.31 to finish wave "C" of 2 up. This would be a big shocker to most, and could even catch the bears off-guard. I still do not have a perfered count going right now, there are just too many options on the table, and until we make a higher high, or lower low things are not going to get much clearer.

11:22, Throwing out an observation here, still too earlier to put much confidence in this, but with the structure of the two waves since yesterday's low at 1078.46, that are very corrective looking, it is possible that we are already in wave 2 up, with only a quick rally left to 1105.94, to hit the 38% retracement level from the high of 1050.31 to finish wave "C" of 2 up. This would be a big shocker to most, and could even catch the bears off-guard. I still do not have a perfered count going right now, there are just too many options on the table, and until we make a higher high, or lower low things are not going to get much clearer. 9:05, The Dollar is heading higher again today, making a new high at $79.41.

9:05, The Dollar is heading higher again today, making a new high at $79.41. 8:23, Here is something that is interesting, The BKX, has already retraced 61.% of the sell-off, possible that it might now be starting a 3rd wave down?

8:23, Here is something that is interesting, The BKX, has already retraced 61.% of the sell-off, possible that it might now be starting a 3rd wave down? Click here for an updated Fib. fan chart!!!

Click here for an updated Fib. fan chart!!!7:46, So far the price action has stayed with-in the fans, now we are at the make or break it point.

Mike want to give you a +1 for your fib.fan chart. Gave me an excellent entry point. Thank you!

ReplyDelete:)

ReplyDeleteMichael my cardinal rule with respect to the pricing of so-called risk assets is to watch the behaviour of the US Dollar. As you seem to be leaning towards the possibility of a deeper stock market correction than most expect, and, in reference to the Dollar chart posted several days ago, do you think the next Dollar resistance point might be where an interim bottom in stocks could develop?

ReplyDeleteMike.. From your chart I take it you see the $USD in wave 3 so this be a big push up correct?

ReplyDeleteDouala, Yes, from the structure of the waves from the Bottom, the Dollar looks like it is in an impulsive wave up, and has not even got to the meat of the rally.

ReplyDeleteThanks for the update. So it looks like you see this continuing on into next week then.

ReplyDeletenice after the close wrap up; i'm favoring cash too right now, though mostly cause i'm in the middle of a huge move of the household, though things in the markets do look "tired" and confused

ReplyDeleteor is that me ;-)

still voting though!

thanks col, 'nother wk or so and hopefully back to paying more attention, blog and lounge wise anyways ;-) best of luck to ya...