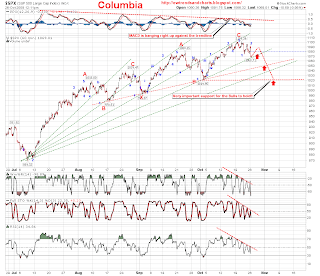

The McCellen Oscillator is showing a buy signal (below 50)!!

The McCellen Oscillator is showing a buy signal (below 50)!! Todays count with the finish of wave i of 3 down, then starting ii of 3 near the close fits really nice in this picture, I was expecting a bounce on the trendline of support, before breaking through. The bearish option would be in the perfect count to do so after a brief correction to the upside, then into iii of 3 down!!

Todays count with the finish of wave i of 3 down, then starting ii of 3 near the close fits really nice in this picture, I was expecting a bounce on the trendline of support, before breaking through. The bearish option would be in the perfect count to do so after a brief correction to the upside, then into iii of 3 down!! We had a full five minor waves down today, completing either wave i of 3 Bearish, or for the Bullish option, completing wave C of a corrective sell-off. Decliners beat out Advancers 3.25:1, on strong sell volume. I expect to see some upside tomorrow, for wave ii of 3, 1075, is 50%, and 1081 is 61.8% retracement. Any levels above 1081 should really alarm the Bears!!!

We had a full five minor waves down today, completing either wave i of 3 Bearish, or for the Bullish option, completing wave C of a corrective sell-off. Decliners beat out Advancers 3.25:1, on strong sell volume. I expect to see some upside tomorrow, for wave ii of 3, 1075, is 50%, and 1081 is 61.8% retracement. Any levels above 1081 should really alarm the Bears!!!118 new 52 week highs, and 8 new 52 week lows.

Mark wrote a very nice blog this morning, Calling the Top.......Who cares? Why you should.

Please recommend this, so we can get Mark blogging more!!

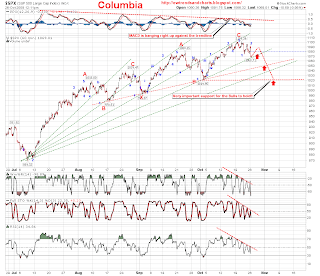

I am watching this Renko chart for clues to see if we are indeed in wave 3 down, or in a corrective sell-off. The RSI is a great tool for finding 3rd waves and should bury itself if that is what is happening. The other option would be a break of the trendline of resistance on the RSI to the upside, that would make me lean more to the option of a corrective action. The MACD is also a good tell, as long as it keeps showing a sell signal and does not cross the most likely option is the bearish wave 3 down.

I am watching this Renko chart for clues to see if we are indeed in wave 3 down, or in a corrective sell-off. The RSI is a great tool for finding 3rd waves and should bury itself if that is what is happening. The other option would be a break of the trendline of resistance on the RSI to the upside, that would make me lean more to the option of a corrective action. The MACD is also a good tell, as long as it keeps showing a sell signal and does not cross the most likely option is the bearish wave 3 down.

SPX is right on the trendline, if the past provides any clues, it would be that a bounce would take place first, before breaking the trendline. I see two different possible outcomes, a 1-2 down(bearish), or a corrective a-b-c down, before another attempt to establish a new high (bullish). The vix is rallying today, and has trendline resistance around 27, currently at 24.28.

SPX is right on the trendline, if the past provides any clues, it would be that a bounce would take place first, before breaking the trendline. I see two different possible outcomes, a 1-2 down(bearish), or a corrective a-b-c down, before another attempt to establish a new high (bullish). The vix is rallying today, and has trendline resistance around 27, currently at 24.28.

Please recommend this, so we can get Mark blogging more!!

I am watching this Renko chart for clues to see if we are indeed in wave 3 down, or in a corrective sell-off. The RSI is a great tool for finding 3rd waves and should bury itself if that is what is happening. The other option would be a break of the trendline of resistance on the RSI to the upside, that would make me lean more to the option of a corrective action. The MACD is also a good tell, as long as it keeps showing a sell signal and does not cross the most likely option is the bearish wave 3 down.

I am watching this Renko chart for clues to see if we are indeed in wave 3 down, or in a corrective sell-off. The RSI is a great tool for finding 3rd waves and should bury itself if that is what is happening. The other option would be a break of the trendline of resistance on the RSI to the upside, that would make me lean more to the option of a corrective action. The MACD is also a good tell, as long as it keeps showing a sell signal and does not cross the most likely option is the bearish wave 3 down. SPX is right on the trendline, if the past provides any clues, it would be that a bounce would take place first, before breaking the trendline. I see two different possible outcomes, a 1-2 down(bearish), or a corrective a-b-c down, before another attempt to establish a new high (bullish). The vix is rallying today, and has trendline resistance around 27, currently at 24.28.

SPX is right on the trendline, if the past provides any clues, it would be that a bounce would take place first, before breaking the trendline. I see two different possible outcomes, a 1-2 down(bearish), or a corrective a-b-c down, before another attempt to establish a new high (bullish). The vix is rallying today, and has trendline resistance around 27, currently at 24.28.

Cool charts Col! I enjoy your use of Renko. Favour the Summation Index over the Oscillator but my time frame might be different from yours, its all about style. Cheers!

ReplyDelete